Financial Conflict of Interest policy

Purpose

The PRNA FCOI policy consists of: Policy and procedure: Financial Conflict of Interest in PHS-Funded Projects. Protocol: Protocol for Handling Financial Conflict of Interest.

Philips Research North America strives to create a research climate that promotes objectivity in research by establishing standards such that the design, conduct and reporting of Public Health Service (PHS, which includes NIH) funded research is free from bias resulting from financial conflict of interest (FCOI).

PHILIPS RESEARCH

Number: 315

Philips Electronics North America Corporation

Effective: 08/24/2012

Supersedes:

Philips Research North America

Approved: 08/24/2012

POLICY AND PROCEDURE

SUBJECT: FINANCIAL CONFLICT OF INTEREST IN PHS-FUNDED PROJECTS

I. POLICY Each such employee must: 1. disclose his or her significant financial interests (SFI)B in non-Philips entities that would appear to be related to the employee’s professional responsibilities on behalf of PRNAC; 2. comply with a FCOI management plan, if a FCOI is identified; and 3. undergo FCOI training, at least once every four years. Disclosure of SFI is essential for PRNA to determine if a FCOI exists, and in cases of FCOI determine how it will be managed and reported in full compliance with government regulation. Non-disclosure of SFI or non-compliance with FCOI management plan may subject the employee to employment discipline including, without limitation, suspension or termination of employment. II. DEFINITIONS A. Financial conflict of interest (FCOI) means a significant financial interest that could directly and significantly affect the design, conduct, or reporting of PHS funded research. 1. Including: 2. Excluding: 3. SFI disclosure also includes travel. Specifically, externally funded reimbursed or sponsored travel that would appear to be related to employee’s PRNA responsibilities, however, that is not funded by Philips. Such travel must be disclosed, no matter the amount, except when the expenses are covered by any of the excluded sourcesD. Note that the threshold of $5000 is applied to the aggregation of 1a and 1b, or to 1c. C. Employee’s professional responsibilities on behalf of PRNA means conducting research, submitting patent applications, publication, technical committee membership and, teaching as adjunct faculty at an Institute of higher education. D. An excluded source means a source of remuneration that is excluded from disclosure. With reference to the SFI (2b and 3), excluded sources are – federal, state, or local government agency, an Institution of higher education, an academic teaching hospital, a medical center, or a research institute that is affiliated with an Institution of higher education. III. PROCEDURE Employees who are planning to or participating in research activity that is either partially or wholly supported by PHS funds must disclose their SFI in a timely fashion, either to a member of the PRNA Management Team (PRNA MT) or the designated PRNA FCOI official. The designated PRNA FCOI official will determine whether the SFI constitutes an FCOI, based on guidance set by the PRNA MT. Consistent with the attached, Protocol for Handling Financial Conflict of Interest, if the SFI is determined to be an FCOI, the PRNA MT will take actions to discuss and approve the implementation of an FCOI management plan consistent with government regulation and, furthermore, to promptly notify the PHS funding component (e.g., NIH) via a FCOI report. As a part of the FCOI management plan, the PRNA MT will decide one or more actions depending upon the situation, including requiring certain disclosure in public presentations, employee role reassignment, reduction or elimination of the financial interest sanctions (e.g., sale of an equity interest) or severance of relationships that create financial conflicts. Employees with an identified FCOI must comply with the FCOI management plan. IV. RELATED POLICIES AND PROCEDURES

Philips Research North America strives to create a research climate that promotes objectivity in research by establishing standards such that the design, conduct and reporting of Public Health Service (PHS, which includes NIH) funded research is free from bias resulting from financial conflict of interest (FCOI)A.

This policy is applicable to each employee who is planning to or is participating in research activity that is either partially or wholly supported by PHS funds. This policy is in addition to Philips’ General Business Principles and Directives (collectively, the “GBPs”) which govern Philips’ business decisions and actions throughout the world and apply equally to corporate actions and to the behavior of individual employees in conducting Philips’ business. If there is a conflict between this policy and the GBPs, the GBPs will govern.

B. Significant Financial Interest (SFI) exists if the value of remuneration received by the employee, employee’s spouse or dependent children that reasonably appear to be related to the employee’s PRNA responsibilities exceeds $5000;

Protocol for Handling Financial Conflict of Interest

V. ADMINSTRATION

The designated PRNA FCOI official is responsible for administration of this policy.

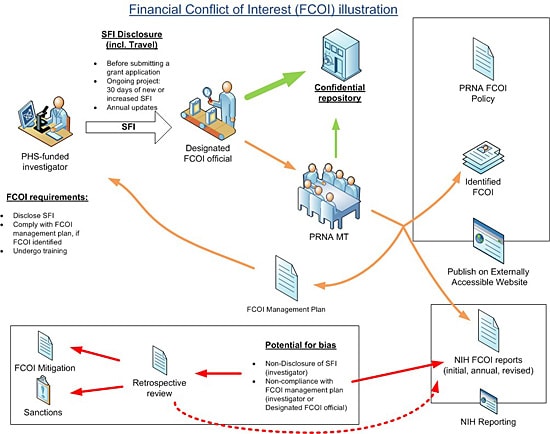

For the purposes of illustration, the following figure is used

Protocol for Handling Financial Conflict of Interest

This protocol along with the policy and procedure titled, Financial Conflict of Interest in PHS-Funded Projects, constitute the PRNA FCOI policy. Capital terms in this protocol shall have the same meaning as set forth in the policy. This protocol outlines the procedure that will be followed as per regulation (Title 42 CFR 50.601-50.607). This document specifies the FCOI protocol for PHS-funded research: that is the step-by-step implementation of the PRNA FCOI policy. 1. Employees planning to participate in PHS-funded research are required to disclose all SFI's prior to submission of an application for PHS-funded research. 2. Once the research project has been funded all PHS-funded investigators shall submit SFI Disclosures within thirty (30) days of acquiring any new or increased SFI, 3. All PHS-funded investigators shall submit an updated SFI disclosure annually. 4.SFI disclosures (except travel) must include the following information: 1. Identity of the sponsor/organizer; and 2.Nature of SFI (e.g., salary, license income, stock). 5. Externally funded travel also constitutes SFI, and therefore the disclosure requirements in 2 (i)-(iii) apply. That is, PHS-funded investigators shall submit SFI Disclosures for externally funded travel: prior to submission of an application for PHS-funded research; and for PHS-funded projects within thirty (30) days of externally funded travel and in an annual update. The following travel related information must be disclosed: 3. Review of disclosures When an SFI that was not disclosed by a PHS-funded Investigator in a timely manner is identified, the designated PRNA FCOI official will determine if FCOI exists, develop and implement a management plan within sixty (60) days after the identification of the SFI. In addition, the designated PRNA FCOI official will conduct a retrospective review of SFIs for the PHS-funded investigator within one hundred twenty (120) days and document it. 1. The role and principal duties of the conflicted PHS-funded Investigator in the research project; 2. Conditions of the management plan (see examples below); 3. How the management plan is designed to safeguard objectivity in the research project; 4. Confirmation of the PHS-funded Investigator’s agreement to the management plan; and 5. How the management plan will be monitored to ensure PHS-funded Investigator compliance. Examples of conditions or restrictions that might be imposed to manage a PHS-funded Investigator’s FCOI include, but are not limited to: 5. Reporting FCOI to PHS Awarding Component (e.g. the NIH) Based on the FCOI management plan, the designated PRNA FCOI official will submit an initial FCOI report to the PHS-funding component, for example NIH. The report will be submitted, for example using eRA Commons for NIH, and consist of all elements required by the regulation. The FCOI report for will be submitted prior to the expenditure of funds under the Notice of Award. FCOIs identified during the period of award will be submitted to NIH within sixty (60) days of identification, including for new investigators joining an ongoing PHS-funded project. Annual FCOI reports (or revised reports as a result of retrospective reviews) will also be submitted and will include the status of financial conflict, i.e., whether the financial conflict is still being managed or explains why the financial conflict no longer exists. These FCOI reports will also include a description of any changes to the management plan since the last FCOI report. 6. Training for FCOI PHS-funded Investigators must undergo training with respect to this Policy and PHS FCOI rules and regulations, as follows: 1. When a new employee joins PRNA; 2.Prior to participating in PHS-funded research, and at least once every four years; 3. When the PRNA FCOI policy changes in a manner that effects PHS-funded Investigator disclosure or compliance requirements; and, 4. If PRNA MT determines that a PHS-funded Investigator is not compliant with the FCOI Policy or an FCOI Management Plan. NIH web-based training (http://grants.nih.gov/grants/policy/coi/tutorial2011/fcoi.html) will be used. Employees must save and print the FCOI Certificate as proof of completion. 7. Sanctions for violation of policy Disclosure of SFI is essential for PRNA to implement its FCOI policy. If a PHS-funded Investigator fails to comply with this policy (with regard for instance to the SFI disclosure requirement or implementation of an FCOI management plan), and appears to have biased the PHS-funded research, the PRNA MT will implement a mitigation plan and require that the Investigator disclose the FCOI in each public presentation of the results of the research, and to remedy previously published presentations with an FCOI disclosure addendum. In addition, the employee may be subject to employment discipline including, without limitation, suspension or termination of employment. In any case, the PHS-funding agency will be promptly notified. 8. Retention of records Records of financial disclosures and any resulting action will be maintained for three (3) years from the date of submission of the final expenditures report. 9. Subrecipient compliance When working with a subrecipient, a written agreement will be put in place to clarify: (a) which organization’s (prime awardee or subrecipient) FCOI policy will be followed, and, (b) in either case, clarify the timeline for disclosure and reporting. Note that the prime awardee is responsible for monitoring subrecipient’ s compliance with the Financial Conflict of Interest regulation, management plans, and for reporting all identified financial conflicts of interest. 10. Public Accessibility As required by PHS regulation, the PRNA FCOI policy is being made accessible on PRNA web site. If a PHS-funded investigator holds financial interests that are determined to be FCOI, as required by PHS regulation, these will also be posted on the web site, as follows: 1. Include the minimum elements required by the regulation; 2. Update within sixty (60) days of a newly identified FCOI; 3. Update annually; and 4. Remain available for three (3) years.

1. Who is required to disclose financial interests

Employees planning to or participating in research activity that is either partially or wholly supported by PHS funds are required to disclose financial interests (“PHS-funded Investigators”).

2. SFI disclosure

PHS-funded Investigators are required to disclose SFIs to either a member of the PRNA MT or the designated PRNA FCOI official, as follows:

All SFI disclosures, including those submitted by a new investigator who joins an ongoing PHS-funded project, will be reviewed by the designated PRNA FCOI official. The review will determine whether an SFI is related to the PHS-funded research and therefore an FCOI. The designated PRNA FCOI official may involve the relevant investigator in the review, and request additional information from the investigator.

4. Management of FCOI

For each disclosure that leads to determination of FCOI, the PRNA MT will discuss and approve the implementation of a management plan developed by the designated PRNA FCOI official. PHS-funded Investigators with an identified FCOI must comply with the management plan. The management plan will include the following elements at a minimum: