Jan 29, 2019

Philips' Fourth Quarter and Annual Results 2018

Philips meets full-year targets, proposes 6% dividend increase and launches new EUR 1.5 billion share buyback program

Philips delivers Q4 sales of EUR 5.6 billion, with 5% comparable sales growth; income from continuing operations increased to EUR 723 million and Adjusted EBITA margin increased to 17.4%

Fourth-quarter highlights Full-year highlights Frans van Houten, CEO “We continued to make progress during the year and delivered 5% comparable sales growth in the fourth quarter, with good mid-single-digit growth in our Diagnosis & Treatment businesses, low-single-digit growth in our Personal Health businesses in line with our expectations for this year, and higher IP royalties. I am encouraged by the comparable order intake growth in the Connected Care & Health Informatics businesses, which drove the 10% comparable order intake growth for the Group. The Adjusted EBITA margin improved by 70 basis points, despite a 40 basis points adverse currency effect. For the full year, we delivered on our targets, with 5% comparable sales growth, 100 basis points improvement in the Adjusted EBITA margin, and a free cash flow of EUR 1.2 billion, excluding payments related to the US Pension Fund liability de-risking and premium payments related to an early bond redemption. We saw rising demand for our innovative product and solutions portfolio, resulting in 10% comparable order intake growth for the year, with good growth across the world. Our continued focus on innovation combined with our growing order book provide a solid base to further strengthen our leadership position as a focused health technology company. This confidence enables us to propose a 6% dividend increase to EUR 0.85 per share and to announce a new EUR 1.5 billion share buyback program. As Philips continues to navigate global geopolitical challenges and market volatility, for which we are taking necessary actions, we expect our performance momentum to improve in the course of the year. We reaffirm our overall targets of 4-6% comparable sales growth and an Adjusted EBITA margin improvement of 100 basis points on average per year for the 2017–2020 period.”

Business segment performance In the quarter, the Diagnosis & Treatment businesses recorded 5% comparable sales growth, driven by double-digit growth in Image-Guided Therapy. Comparable order intake showed a low-single-digit increase on the back of double-digit growth in Q4 2017. The order intake growth was driven by double-digit growth in Diagnostic Imaging. The Adjusted EBITA margin increased to 15.9%, mainly due to growth and operational improvements. For the full year, the Diagnosis & Treatment businesses delivered 7% comparable sales growth and an increased Adjusted EBITA margin of 11.6%. The Connected Care & Health Informatics businesses delivered a double-digit increase in comparable order intake in the fourth quarter, driven by Monitoring & Analytics and Healthcare Informatics. Comparable sales remained flat, with low-single-digit growth in Monitoring & Analytics. The Adjusted EBITA margin decreased to 16.1%, mainly due to lower growth. For the full year, the Connected Care & Health Informatics businesses’ sales were in line with 2017 on a comparable basis, while the Adjusted EBITA margin decreased to 11.1%. The Personal Health businesses delivered comparable sales growth of 3% in Q4 2018, driven by high-single-digit growth in Sleep & Respiratory Care. The Adjusted EBITA margin decreased to 18.6%, reflecting lower growth. For the full year, the Personal Health businesses delivered 3% comparable sales growth and an increase in Adjusted EBITA margin to 16.8%. Philips’ ongoing focus on innovation and strategic partnerships resulted in the following highlights in the quarter: Cost savings In the fourth quarter, procurement savings amounted to EUR 79 million. Overhead and other productivity programs delivered savings of EUR 56 million, contributing to annual savings of EUR 466 million in 2018. Capital allocation A proposal will be submitted to the Annual General Meeting of Shareholders, to be held on May 9, 2019, to declare a distribution of EUR 0.85 per common share, in cash or shares at the option of the shareholder, against the net income for 2018. On June 28, 2017, Philips announced its current EUR 1.5 billion share buyback program for capital reduction purposes. Under that program, which was initiated in the third quarter of 2017, Philips repurchased shares in the open market and entered into a number of forward transactions, some of which are yet to be settled in Q2 2019. Further details can be found here. Today, Philips announces a new share buyback program for an amount of up to EUR 1.5 billion. At the current share price, the program represents a total of approximately 46 million shares. Philips expects to start the program in the first quarter of 2019 and to complete it within two years. Updates on the progress of the program will be provided through press releases and further details will be available here. As the program will be initiated for capital reduction purposes, Philips intends to cancel all of the shares acquired under the program. The program will be executed by an intermediary to allow for purchases in the open market during both open and closed periods, in accordance with the EU Market Abuse Regulation. Reporting segment re-alignment as of Q1 2019 To further align its businesses with customer needs, Philips has re-aligned its three reporting segments Diagnosis & Treatment, Connected Care & Health Informatics, and Personal Health. Effective as of January 1, 2019, the most notable changes are the shift of the Sleep & Respiratory Care business from the Personal Health segment to the renamed Connected Care segment, and the shift of most of the Healthcare Informatics business from the Connected Care segment to the Diagnosis & Treatment segment. The Group targets for the 2017-2020 period remain unchanged. Regulatory update Philips has continued to make progress towards fulfilling its obligations under the Consent Decree, which is primarily focused on defibrillator manufacturing in the US. Currently Philips is awaiting feedback from the FDA, which has been postponed due to the recent partial US Government shutdown. Signify Philips’ shareholding in Signify is currently 16.5% of Signify’s issued share capital. With Philips CFO Abhijit Bhattacharya stepping down from the Supervisory Board of Signify as of December 31, 2018, the remaining stake is presented as a financial asset at market value, based on Signify’s stock price. Value adjustments of the retained interest from this date will be recognized in Other Comprehensive Income outside of the Income statement. For Q4 2018, value adjustments of the retained interest are shown within Discontinued operations. Philips reiterates its intention to fully sell down its stake over time.

Quarterly Report Fourth Quarter and Annual Results 2018 - Quarterly Report Presentation Fourth Quarter and Annual Results 2018 - Quarterly Results Presentation Conference call and audio webcast A conference call with Frans van Houten, CEO, and Abhijit Bhattacharya, CFO, to discuss the results will start at 10:00AM CET, January 29, 2019. A live audio webcast of the conference call will be available through the link below. Q4 2018 – Fourth quarter and full year 2018 results conference call audio webcast More information about Frans van Houten and Abhijit Bhattacharya Click here for Mr. van Houten's CV and images Click here for Mr. Bhattacharya's CV and images

Visit our interactive results hub for more on our financial and sustainability performance over the past quarter, including the latest version of our dynamic Lives Improved world map.

About Royal Philips

Royal Philips (NYSE: PHG, AEX: PHIA) is a leading health technology company focused on improving people's health and enabling better outcomes across the health continuum from healthy living and prevention, to diagnosis, treatment and home care. Philips leverages advanced technology and deep clinical and consumer insights to deliver integrated solutions. Headquartered in the Netherlands, the company is a leader in diagnostic imaging, image-guided therapy, patient monitoring and health informatics, as well as in consumer health and home care. Philips generated 2018 sales of EUR 18.1 billion and employs approximately 77,000 employees with sales and services in more than 100 countries. News about Philips can be found at www.philips.com/newscenter.

Forward-looking statements and other important information

Forward-looking statements These factors include but are not limited to: global economic and business conditions; political instability, including developments within the European Union, with adverse impact on financial markets; the successful implementation of Philips’ strategy and the ability to realize the benefits of this strategy; the ability to develop and market new products; changes in legislation; legal claims; changes in currency exchange rates and interest rates; future changes in tax rates and regulations, including trade tariffs; pension costs and actuarial assumptions; changes in raw materials prices; changes in employee costs; the ability to identify and complete successful acquisitions, and to integrate those acquisitions into the business, the ability to successfully exit certain businesses or restructure the operations; the rate of technological changes; cyber-attacks, breaches of cybersecurity; political, economic and other developments in countries where Philips operates; industry consolidation and competition; and the state of international capital markets as they may affect the timing and nature of the disposal by Philips of its remaining interests in Signify. As a result, Philips’ actual future results may differ materially from the plans, goals and expectations set forth in such forward-looking statements. For a discussion of factors that could cause future results to differ from such forward-looking statements, see the Risk management chapter included in the Annual Report 2017. Third-party market share data Statements regarding market share, including those regarding Philips’ competitive position, contained in this document are based on outside sources such as research institutes, industry and dealer panels in combination with management estimates. Where information is not yet available to Philips, those statements may also be based on estimates and projections prepared by outside sources or management. Rankings are based on sales unless otherwise stated. Use of non-IFRS information In presenting and discussing the Philips Group’s financial position, operating results and cash flows, management uses certain non-IFRS financial measures. These non-IFRS financial measures should not be viewed in isolation as alternatives to the equivalent IFRS measures and should be used in conjunction with the most directly comparable IFRS measures. Non-IFRS financial measures do not have standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. A reconciliation of these non-IFRS measures to the most directly comparable IFRS measures is contained in this document. Further information on non-IFRS measures can be found in the Annual Report 2017. Use of fair value information In presenting the Philips Group’s financial position, fair values are used for the measurement of various items in accordance with the applicable accounting standards. These fair values are based on market prices, where available, and are obtained from sources that are deemed to be reliable. Readers are cautioned that these values are subject to changes over time and are only valid at the balance sheet date. When quoted prices or observable market data are not readily available, fair values are estimated using appropriate valuation models and unobservable inputs. Such fair value estimates require management to make significant assumptions with respect to future developments, which are inherently uncertain and may therefore deviate from actual developments. Critical assumptions used are disclosed in the Annual Report 2017 and Semi-Annual report 2018. In certain cases independent valuations are obtained to support management’s determination of fair values. Presentation All amounts are in millions of euros unless otherwise stated. Due to rounding, amounts may not add up precisely to totals provided. All reported data is unaudited. Financial reporting is in accordance with the accounting policies as stated in the Annual Report 2017 and Semi-Annual report 2018, unless otherwise stated. References to 'Signify' in this press release relate to Philips' former Lighting segment (prior to deconsolidation as from the end of November 2017 and when reported as discontinued operations), Philips Lighting N.V. (before or after such deconsolidation) or Signify N.V. (after its renaming in May 2018), as the context requires. References to Lumileds in this press release relate to the combined Lumileds and Automotive businesses, which were deconsolidated as from the end of June 2017. Market Abuse Regulation This press release contains inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation.

This document and the related oral presentation, including responses to questions following the presentation, contain certain forward-looking statements with respect to the financial condition, results of operations and business of Philips and certain of the plans and objectives of Philips with respect to these items. Examples of forward-looking statements include statements made about the strategy, estimates of sales growth, future Adjusted EBITA, future developments in Philips’ organic business and the completion of acquisitions and divestments. By their nature, these statements involve risk and uncertainty because they relate to future events and circumstances and there are many factors that could cause actual results and developments to differ materially from those expressed or implied by these statements.

Topics

Contacts

Ben Zwirs

Philips Global Press Office Tel: +31 6 1521 3446

You are about to visit a Philips global content page

Continue

Martijn van der Starre

Philips Global Press Office Tel: +31 6 2847 4617

You are about to visit a Philips global content page

ContinueBusiness Highlights Q4 2018

Philips surpasses 10 million DreamWear masks and cushions sold worldwide

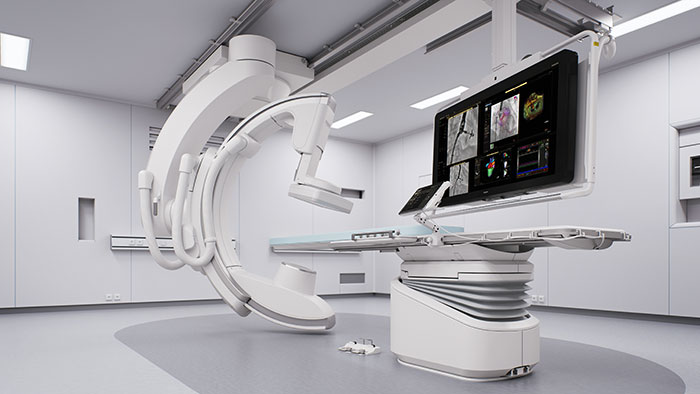

Philips launches Azurion with FlexArm to set new standard for the future of image-guided procedures

County Durham and Darlington NHS Foundation Trust and Philips Agree 14 Year Partnership to unlock potential in radiology and cardiology

Press releases

Get our press releases by e-mail

You are about to visit a Philips global content page

Continue