Jan 28, 2020

Philips' Fourth Quarter and Annual Results 2019

Philips delivers Q4 sales of EUR 6 billion, with 3% comparable sales growth; income from continuing operations amounted to EUR 550 million and Adjusted EBITA margin increased to 17.9%

Fourth-quarter highlights Full-year highlights Company update Frans van Houten, CEO: “I am encouraged that the three business segments together delivered 4% comparable sales growth and an Adjusted EBITA margin improvement of 120 basis points in the fourth quarter, despite a more challenging environment. This performance was partly offset by lower IP royalties compared to Q4 2018, resulting in 3% comparable sales growth and an Adjusted EBITA margin improvement of 50 basis points for the Group. Comparable order intake grew a further 3%, on the back of strong 10% growth in Q4 2018. For the full year, we are pleased to have grown the company to EUR 19.5 billion sales with 4.5% comparable sales growth, achieving a free cash flow of more than EUR 1 billion, and increasing adjusted earnings per share from continuing operations by 15%. Our profitability improvement of 10 basis points for the year fell short of our plan, partly due to headwinds.

Looking ahead at 2020 we continue to see geopolitical and economic risks. We aim for 4-6% comparable sales growth and an Adjusted EBITA margin improvement of around 100 basis points, with a performance momentum that is expected to improve in the course of the year.”

Business segment performance In the fourth quarter, all business segments delivered growth and increased profitability. The Diagnosis & Treatment businesses recorded 5% comparable sales growth in the quarter, driven by high-single-digit growth in Image-Guided Therapy and mid-single-digit growth in Ultrasound. Comparable order intake showed a low-single-digit increase on the back of high-single-digit growth in Q4 2018. The order intake growth was driven by double-digit growth in China and Western Europe. The Adjusted EBITA margin increased to 16.3%, mainly due to sales growth, partly offset by investments and tariffs. For the full year, the Diagnosis & Treatment businesses delivered 5% comparable sales growth and an increased Adjusted EBITA margin of 12.7%. The Connected Care businesses delivered 2% comparable sales growth in the quarter, driven by mid-single-digit growth in Monitoring & Analytics. Comparable order intake showed a mid-single-digit increase, driven by double-digit growth in North America and China. The Adjusted EBITA margin increased to 19.4%, mainly due to sales growth and productivity, partly offset by the impact of tariffs. For the full year, the Connected Care businesses delivered 3% comparable sales growth and the Adjusted EBITA margin decreased to 13.2%. The Personal Health businesses delivered comparable sales growth of 4% in the quarter, driven by double-digit growth in Oral Healthcare and mid-single-digit growth in Personal Care. The Adjusted EBITA margin increased to 20.1%, mainly due to sales growth, a positive mix impact and productivity, partly offset by tariffs. For the full year, the Personal Health businesses delivered 5% comparable sales growth and an increase in Adjusted EBITA margin to 16.1%. Philips’ ongoing focus on innovation and strategic partnerships to make the world healthier and more sustainable resulted in the following highlights in the quarter and the full year: Domestic Appliances review Philips announced this morning that it will review options for future ownership of the Domestic Appliances business, and start the process of creating a separate legal structure for this business. The Domestic Appliances business is a global leader with EUR 2.3 billion sales in 2019 in kitchen appliances, coffee, garment care and home care appliances. Frans van Houten: “The Domestic Appliances business has significantly contributed to Philips, but it is not a strategic fit for our future as a health technology leader, as we choose to further sharpen our focus along the health continuum and invest in our consumer health and professional healthcare-related businesses.” Executive Committee management changes Roy Jakobs, currently Chief Business Leader of the Personal Health businesses, has been appointed as the new Chief Business Leader of the Connected Care businesses with immediate effect. He succeeds Carla Kriwet, who will leave the company. Frans van Houten: “On behalf of Philips’ Executive Committee, I want to thank Carla for her contributions to Philips, and wish her the best in her future endeavors. At the same time, I am pleased to announce Roy as the new leader of the Connected Care businesses and would like to highlight his global leadership experience, with a strong business performance record, and accomplishments in strategy, digital innovation and new business development in the business-to-consumer and business-to-business domains.” A successor for the Personal Health Chief Business Leader role will be announced in due course. Philips CEO Frans van Houten will lead the Personal Health businesses on an interim basis. Cost savings In the fourth quarter of 2019, cost savings totaled EUR 125 million, with procurement savings of EUR 39 million and savings from overhead and other productivity programs of EUR 86 million, resulting in annual savings of EUR 480 million in 2019. Capital allocation As of the end of the fourth quarter of 2019, Philips has completed 41.5% of its EUR 1.5 billion share buyback program for capital reduction purposes that was announced on January 29, 2019. Further details can be found here. In the quarter, Philips completed the cancellation of 8.5 million shares that were acquired as part of the share buyback program mentioned above. At the end of the fourth quarter of 2019, the total number of issued shares outstanding was 890,973,790 shares, compared to 914,184,087 shares at the end of the fourth quarter of 2018. Regulatory update Philips continues to address the follow-up requests of the US Food and Drug Administration (FDA) as part of its efforts to fulfill its obligations under the Consent Decree [1] and remains in dialogue with the agency. [1] Under the Consent Decree, Philips continues to export its range of AED devices and manufacture and distribute its HS1/OnSite/Home automated external defibrillator (AED) model in the US. The company may also continue to service the AEDs provided that certain conditions are met and provide consumables and the relevant accessories.

Report Fourth Quarter and Annual Results 2019 - Report Presentation Fourth Quarter Results 2019 - Results Presentation Media round table Conference call and audio webcast A conference call with Frans van Houten, CEO, and Abhijit Bhattacharya, CFO, to discuss the results will start at 10:00AM CET, January 28, 2020. A live audio webcast of the conference call will be available through the link below. Q4 2019 – Fourth quarter and full year 2019 results conference call audio webcast More information about Frans van Houten and Abhijit Bhattacharya Click here for Mr. van Houten's CV and images Click here for Mr. Bhattacharya's CV and images

Fourth Quarter Results 2019 - Media round table

Visit our interactive results hub for more on our financial and sustainability performance over the past quarter, including the latest version of our dynamic Lives Improved world map.

About Royal Philips

Royal Philips (NYSE: PHG, AEX: PHIA) is a leading health technology company focused on improving people's health and enabling better outcomes across the health continuum from healthy living and prevention, to diagnosis, treatment and home care. Philips leverages advanced technology and deep clinical and consumer insights to deliver integrated solutions. Headquartered in the Netherlands, the company is a leader in diagnostic imaging, image-guided therapy, patient monitoring and health informatics, as well as in consumer health and home care. Philips generated 2019 sales of EUR 19.5 billion and employs approximately 80,000 employees with sales and services in more than 100 countries. News about Philips can be found at www.philips.com/newscenter.

Forward-looking statements and other important information

Forward-looking statements These factors include but are not limited to: changes in industry or market circumstances; economic and political developments; Philips’ increasing focus on health technology; the realization of Philips’ growth ambitions and results in growth geographies; lack of control over certain joint ventures; integration of acquisitions; securing and maintaining Philips’ intellectual property rights and unauthorized use of third-party intellectual property rights; compliance with quality standards, product safety laws and good manufacturing practices; exposure to IT security breaches, IT disruptions, system changes or failures; supply chain management; ability to create new products and solutions; attracting and retaining personnel; financial impacts from Brexit; compliance with regulatory regimes, including data privacy requirements; governmental investigations and legal proceedings with regard to possible anticompetitive market practices and other matters; business conduct rules and regulations; treasury risks and other financial risks; tax risks; costs of defined-benefit pension plans and other postretirement plans; reliability of internal controls, financial reporting and management process. As a result, Philips’ actual future results may differ materially from the plans, goals and expectations set forth in such forward-looking statements. For a discussion of factors that could cause future results to differ from such forward-looking statements, see also the Risk management chapter included in the Annual Report 2018. Third-party market share data Statements regarding market share, including those regarding Philips’ competitive position, contained in this document are based on outside sources such as research institutes, industry and dealer panels in combination with management estimates. Where information is not yet available to Philips, those statements may also be based on estimates and projections prepared by outside sources or management. Rankings are based on sales unless otherwise stated. Use of non-IFRS information In presenting and discussing the Philips Group’s financial position, operating results and cash flows, management uses certain non-IFRS financial measures. These non-IFRS financial measures should not be viewed in isolation as alternatives to the equivalent IFRS measure and should be used in conjunction with the most directly comparable IFRS measures. Non-IFRS financial measures do not have standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. A reconciliation of these non-IFRS measures to the most directly comparable IFRS measures is contained in this document. Further information on non-IFRS measures can be found in the Annual Report 2018. Use of fair value information In presenting the Philips Group’s financial position, fair values are used for the measurement of various items in accordance with the applicable accounting standards. These fair values are based on market prices, where available, and are obtained from sources that are deemed to be reliable. Readers are cautioned that these values are subject to changes over time and are only valid at the balance sheet date. When quoted prices or observable market data are not readily available, fair values are estimated using appropriate valuation models and unobservable inputs. Such fair value estimates require management to make significant assumptions with respect to future developments, which are inherently uncertain and may therefore deviate from actual developments. Critical assumptions used are disclosed in the Annual Report 2018. In certain cases independent valuations are obtained to support management’s determination of fair values. Presentation All amounts are in millions of euros unless otherwise stated. Due to rounding, amounts may not add up precisely to totals provided. All reported data is unaudited. Financial reporting is in accordance with the accounting policies as stated in the Annual Report 2018, except for IFRS 16 lease accounting, which is implemented per January 1, 2019 and the adoption of IFRIC 23 Uncertainty over Income Tax Treatments effective January 1, 2019, resulting in a balance sheet reclassification. In addition, certain prior-year amounts have been reclassified to conform to the current year presentation. As announced on January 10, 2019, Philips has realigned the composition of its reporting segments effective as of January 1, 2019. The most notable changes are the shifts of the Sleep & Respiratory Care business from the Personal Health segment to the renamed Connected Care segment and most of the Healthcare Informatics business from the renamed Connected Care segment to the Diagnosis & Treatment segment. Accordingly, the comparative figures have been restated. The restatement has been published on the Philips Investor Relations website and can be accessed here. Market Abuse Regulation This press release contains inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation.

This document and the related oral presentation, including responses to questions following the presentation, contain certain forward-looking statements with respect to the financial condition, results of operations and business of Philips and certain of the plans and objectives of Philips with respect to these items. Examples of forward-looking statements include: statements made about the strategy; estimates of sales growth; future Adjusted EBITA; future restructuring, acquisition-related and other costs; future developments in Philips’ organic business; and the completion of acquisitions and divestments. By their nature, these statements involve risk and uncertainty because they relate to future events and circumstances and there are many factors that could cause actual results and developments to differ materially from those expressed or implied by these statements.

Topics

Contacts

Ben Zwirs

Philips Global External Relations

You are about to visit a Philips global content page

Continue

Martijn van der Starre

Philips Global Press Office Tel: +31 6 2847 4617

You are about to visit a Philips global content page

ContinueBusiness Highlights Q4 2019

Philips continues to set the standard in integrated solutions for image-guided therapy with the expansion of its Azurion platform with FlexArm and the seamless integration of its smart catheters in the platform.

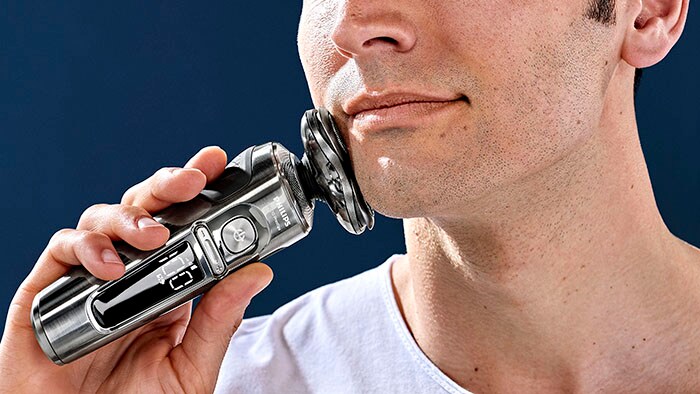

The global roll-out of Philips’ premium Shaver S9000 Prestige with BeardAdapt Sensor and mid-range Shaver S7000 with a personalized solution for sensitive skin supported strong performance of the Male Grooming business in the quarter.

Philips expanded its General Care solutions portfolio with the launch of the EarlyVue VS30 in the US.

Press releases

Get our press releases by e-mail

You are about to visit a Philips global content page

Continue