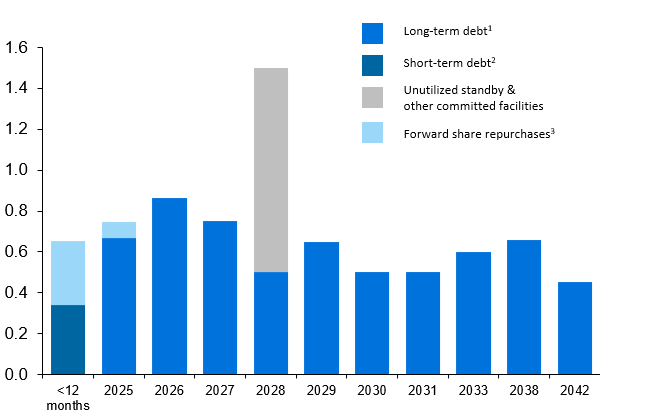

Debt structure

The debt of Royal Philips consists of bonds (USD and EUR), forward contracts, leases (finance and operating) and bank borrowings. Additionally, Philips has a EUR 1 billion committed revolving credit facility which will expire in March 2028. The facility can be used for general group purposes, such as a backstop of its Commercial Paper Program. The Commercial Paper Program amounts to USD 2.5 billion, under which Philips can issue commercial paper up to 364 days in tenor, both in the US and in Europe, in any major freely convertible currency. As per the end of Q4 2023, there is no commercial paper outstanding under the program. The total net debt of Philips per december 31, 2023 is EUR 5.8 billion. The long-term debt has maturities up to 2042 and an average tenor of 6.8 years. The graph below shows the debt maturity profile as per 31 December, 2023:

Debt maturity profile as per December 31, 2023

(in billions of EUR unless otherwise stated)

1. Excluding long-term operating leases 2. Short-term debt includes local credit facilities that are being rolled forward on a continuous basis as well as Commercial Paper 3. Includes forward transactions entered as part of share repurchase programs for share cancellation and LTI purposes

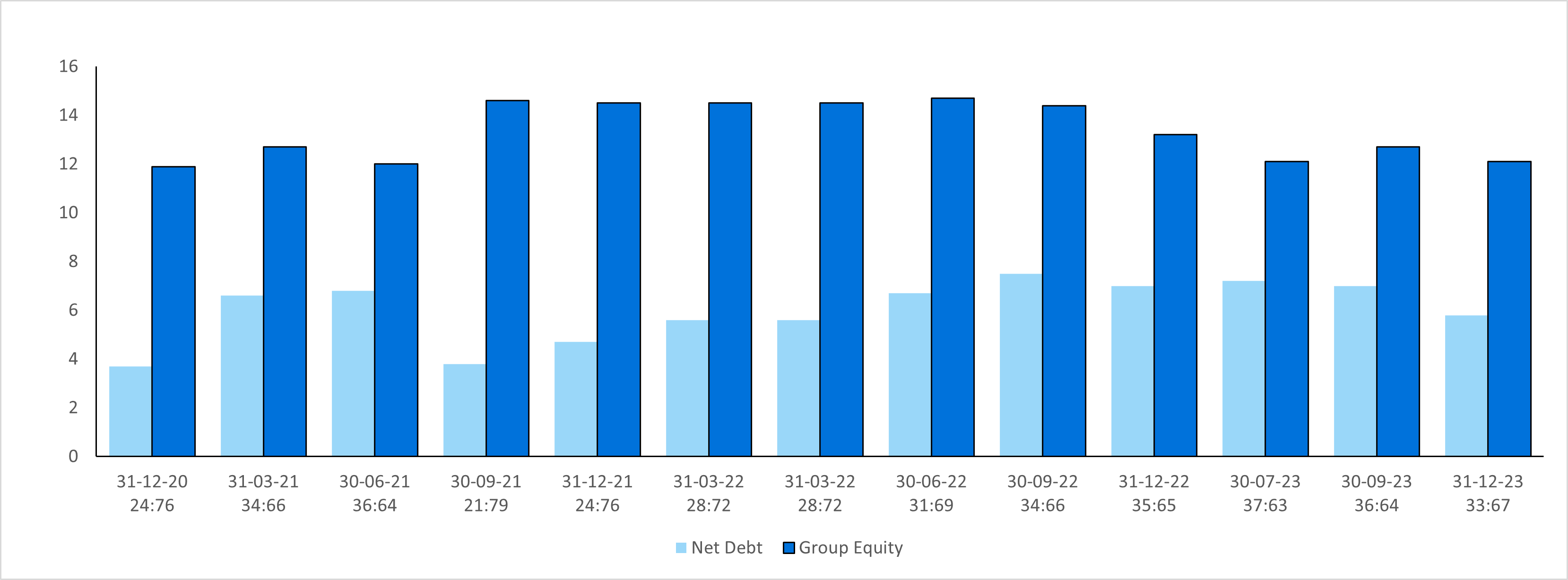

Net debt: Group equity

(in billions of EUR unless otherwise stated)

The Net debt: Group equity ratio provides insight in the financial strength of Philips. This measure is used by Philips management and investment analysts to evaluate financial strength and funding requirements.

Contact Investor Relations

Leandro Mazzoni

Head of Investor Relations

Dorin Danu

Investor Relations Director

Rashiq Muhaimen

Investor Relations Manager – ESG related topics

Monique

van der HeidenCorporate Access Manager